Context

AI assistants are rapidly entering sectors traditionally dominated by human experts —finance, law, and healthcare among them. In the financial space, AI-powered Wealth Assistants or Debt Managers have been gaining momentum and are now thriving with the genAI wave.

The upside? Massive productivity and scale. A cryptocurrency exchange can now democratize financial knowledge and services, with an AI Investment Assistant engaging 10,000+ users daily. These assistants, powered by agentic systems, offer personalized recommendations by leveraging user data and domain-specific insights.

The downside? Compliance overhead scales just as fast. That same cryptocurrency exchange must now increase its quality assurance and regulatory controls just to match the output of an assistant equivalent to several human investment advisors. Manual review of thousands of assistant inputs and outputs daily is simply not viable.

While big tech offers generic guardrails, these fall short in specialized, high-stakes contexts like B2C investment advice under EU regulation—namely the Markets in Financial Instruments EU Directive (MiFID2) or the Consumer Credit Directive. And that’s not all. AI-specific legislation like the EU AI Act and financial-specific legislation like Digital Operational Resilience Act (DORA) are adding new layers of mandatory controls: testing, risk mitigation and evidence-based compliance.

This new legislation requires companies to justify that their AI assistants behave as intended and do not cross any red lines. Gen AI’s lack of predictability, now augmented by increasingly powerful agentic workflows, demands new types of scalable controls.

Investment Guard: expert guardrails for the financial industry

Alinia is committed to tackling this problem at scale for financial enterprises. We developed the first guardrails expert system based on financial regulatory requirements in the EU: Investment Guard. More precisely, we finetuned an LLM informed by MiFID2 and its set of guidelines to interpret when investment advice is being provided by AI assistants. Investment Guard is able to detect and block when AI assistants are giving unqualified investment advice based on MiFID2.

Investment Guard is able to detect both generic financial advice and specific investment advice as per MiFID2. The latter is broken down into 3 specific metrics:

- A Recommendation being made

- The inclusion of Personalized information

- Reference to a Financial instrument

Why Investment Guard Delivers ROI from Day One

Investment Guard offers immediate advantages over off-the-shelf guardrails:

✅ Regulatory Precision

Trained on EU financial regulation, it detects subtle, domain-specific violations—keeping assistants helpful without crossing legal lines.

✅ Compliance at Scale

Automates monitoring and enforcement of MiFID II-aligned guardrails across all user interactions—giving compliance teams peace of mind, and enabling executive confidence.

✅ Accelerated Deployment

Boosts trust and safety in AI rollouts—removing the biggest bottleneck to bringing genAI financial products to market.

✅ Seamless User Experience

Minimal latency added to your pipeline—so you stay compliant without compromising UX.

Benchmarks

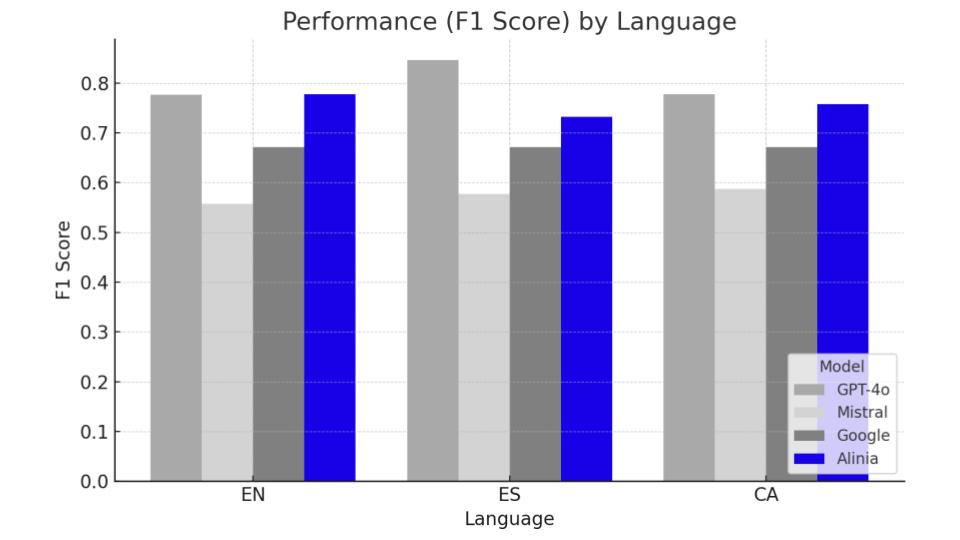

Comprehensive benchmarking on proprietary Alinia datasets containing curated content labeled by legal experts shows that Alinia outperforms existing solutions like Mistral’s financial advice detector and Google’s financial content API. Furthermore, our model compares with OpenAI’s GPT-4o in terms of performance, providing results in a much faster time frame.

Alinia’s investment advice detection outpaces finance-focused guardrails competition by a wide margin across English, Catalan, and Spanish. F1 scores hover around 0.73-0.77, compared to Mistral’s 0.55–0.58 and Google’s 0.66–0.68. Furthermore, it competes with GPT-4o, which provides F1 scores of 0.77-0.84.

It is important to note that Mistral API labels any financial advice, not only investment advice. Google detects any financial content. GPT-4o was prompted to classify content according to the MiFID II definition.

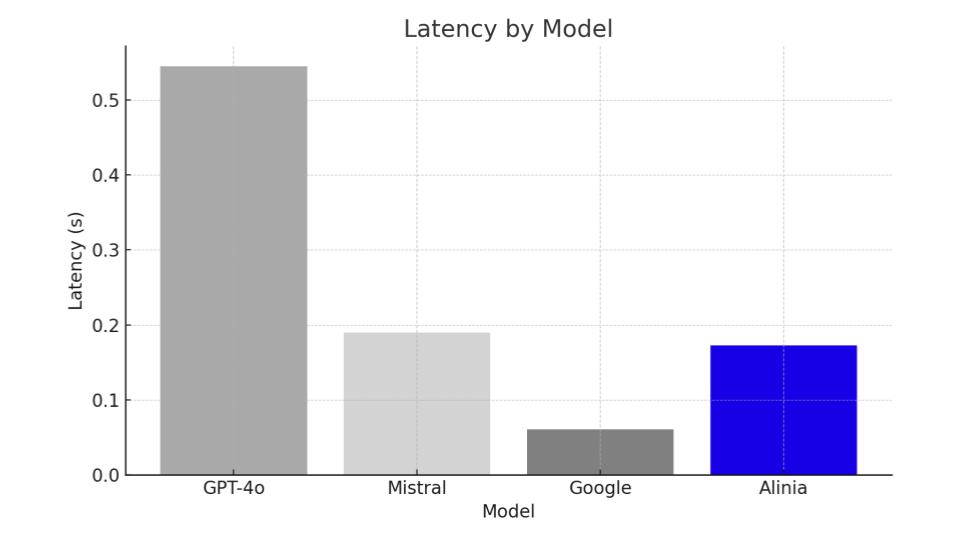

Regarding latency, Alinia’s Investment Guard is just ~175 ms median latency, versus Mistral at ~190 ms, GPT at ~545 ms. In practical terms, Alinia is roughly 4× faster than GPT-4o, and 10% faster than Mistral.

When moving prototypes to production, balancing performance and latency is crucial. GPT-4o, while slightly better in Spanish and Catalan, is four times slower than Alinia, making it unsuitable for production. Google’s API offers fast responses but sacrifices 10% accuracy. Alinia strikes the ideal balance between performance and latency.

Try Investment Guard Today

Launching LLM-powered assistants in finance means more than just automation—it means owning compliance. Without business-specific and regulation-informed guardrails, genAI projects get blocked—or worse, deployed without oversight, leading to: Regulatory fines, consumer harm, and reputational damage.

If you are seeking to deploy LLM-powered virtual assistants and need state-of-the-art investment advice detection, Alinia’s Investment Guard is the most effective solution.

🚀 Contact us to learn more and integrate our Guardrails into your AI workflows!